Common Nonprofit Board Responsibilities

Responsibilities for Nonprofit Boards

One of the fundamental, legal responsibilities of a nonprofit board is to provide oversight and accountability for the organization. Board members serve as a guiding body, providing insights and actionable steps to navigate a path toward the nonprofit’s mission. Overall, the board is responsible for ensuring that the organization is appropriately stewarding the resources entrusted to it and following all legal and ethical standards, which is often referred to as the ‘fiduciary’ responsibility. Below, discover the recommended practices and governance options that help members successfully fulfill these key responsibilities.

Common Nonprofit Governance Practices

BoardSource has codified many of these legal and ethical standards as a part of our Recommended Board Practices, which includes the following recommendations:

- The board should have more than the one annual meeting required by law. Most state laws require at least one annual meeting, but BoardSource believes that one meeting is insufficient for boards to provide proper oversight.

- The board must formalize a process for setting appropriate compensation for the chief executive and the full board should approve the compensation package. This ensures that the full board is confident that the chief executive is being appropriately compensated and that the organization is not opening the organization to the risks of excessive or inadequate compensation.

- The full board should review the Form 990 before it is filed. This ensures that board members are familiar with the information reported on the 990 and that it accurately reflects the organization’s financial and operating environment.

- The board must ensure that there are policies related to disclosing and managing conflicts of interest and that there is a strong whistleblower process in place.

- The board should ensure that an annual audit is conducted and that the board engages directly with the audit firm to discuss the results.

To increase transparency around organizational practices, including the work of the board, nonprofit organizations can update their Candid (formerly GuideStar) profile to provide additional information about their leadership practices. Learn more about BoardSource’s partnership with Candid.

Lead with Learning

True oversight and accountability goes far beyond these core practices and requires active engagement from each individual board member. Effective nonprofit leadership in these areas requires a comprehensive understanding of the organization and a willingness to continuously learn. From practical advice for first-time board members to deep, analytical dives for seasoned ones, BoardSource has a number of relevant resources to explore to find out more.

Quick Access:

Visual & Written Info

Guides, tools, templates, and infographics

Publications: books and toolkits

Written resources: 101, 201, and 301-level

Sign-up to receive our communications; we’re always adding new resources and will send them to you directly.

Guides, Tools, Templates, and Infographics

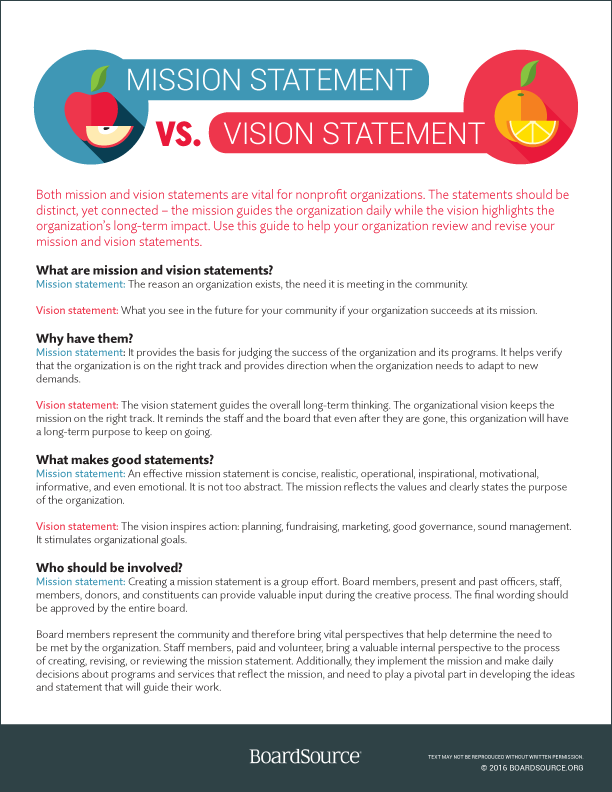

Ethos of Transparency

Members-only

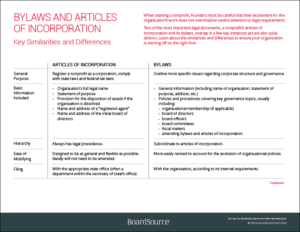

Bylaws: Effective Rules for Your Board

Members-only

Programmatic Oversight Tool

Members-only

Identifying and Managing Risk

Members-only