Form 990 for Non-Profit Organizations

What is a 990 Form?

Form 990 is the main tool used by the Internal Revenue Service (IRS) to verify that a nonprofit organization meets its tax-exempt requirements. It also serves as a means to monitor changes in the sector in general and as a source of information for state regulators and the public at large. Because the Form 990 is a public document, you should pay special attention to your organization’s “profile” and describe your organization’s activities and accomplishments accurately.

Who must file Form 990?

Nonprofit organizations must file the Form 990, the form 990 EZ, N or Z or if they’re small enough, notify the IRS of their existence. Upon request, 990s must be made available to the public. They are commonly added to an organization’s website for public viewing and several months or a year after filing available on Candid’s Guidestar database or Pro-Publica’s Nonprofit Explorer. Potential donors may research your organization to verify that it is a legitimate charitable organization.

Form 990 Instructions

Organizations should visit the IRS website and determine which version of the Form 990 to file. Additional schedules are required depending upon the activities and type of the organization. In our comprehensive resource for members, we walk through the structure of the form, schedules, required governing documents, definitions, and tips.

Organizations must also report in Schedule O how you make the Form 990 — as well as your financial statements, governing documents, and your conflict-of-interest policy — available to the public. In addition, you need to indicate in the core form (Part VI, Section C) how the public can contact the person who is responsible for maintaining these records.

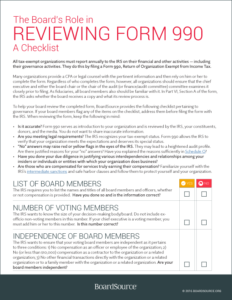

The Board’s Role in Form 990 – A Checklist

In Part VI, Section A of the Form 990, the IRS asks whether the board receives a copy and what its review process is. To help your board review the completed form, download this checklist pertaining to governance. The form outlines key areas your nonprofit should address, such as

- compensation of board members

- mission and programs

- delegation of authority

Form 990 – Frequently Asked Questions

Yes, tax-exempt nonprofit organizations in the U.S. are required by law to make their IRS Form 990 available for public inspection. This includes the three most recent years of Form 990, 990-EZ, or 990-PF. Organizations must provide copies upon request or ensure they are accessible online through publicly available sources. Failure to comply can result in penalties from the IRS.

Nonprofits commonly post their Form 990s on their official websites under a “Financials” or “Transparency” section. Additionally, they can be accessed through third-party databases such as:

- IRS Tax Exempt Organization Search (irs.gov)

- GuideStar by Candid (guidestar.org)

- Charity Navigator (charitynavigator.org)

- ProPublica Nonprofit Explorer (projects.propublica.org)

These platforms allow the public, donors, and stakeholders to review a nonprofit’s financial and operational information.

You can download a Form 990 template directly from the IRS website (irs.gov) by searching for “Form 990 PDF.” The IRS provides multiple versions of the form, including:

- Form 990

- Form 990-EZ

- Form 990-N (e-Postcard)

If you need a fillable or editable template, you can find versions through tax software providers, nonprofit accounting firms, and financial management tools designed for nonprofits.